Asset allocation and Portfolio Construction

Asset allocation and Portfolio Construction

Having established the factors of risk that can be combined to form a suitable portfolio – and a means for measuring its risk – we can now step through the process of building a portfolio. The example below is based on the shape of EBI Portfolio 60 with 40% invested in fixed income.

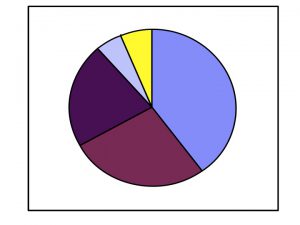

Step 1. Determine the basic Equity/Fixed Income split

Factors to consider are:

• Tolerance for volatility: the lower the tolerance, the greater the proportion of fixed income.

• Time Horizon: the sooner cash outflows are required, the less exposure to equities.

• Human Capital: the higher the present value of future earnings – the greater the exposure to equities.

Asset Allocation

Fixed Income 40%

Fixed Income 40%

Equity 60%

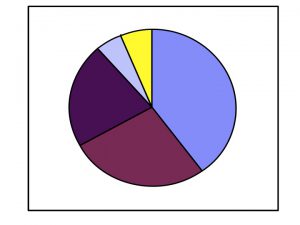

Step 2. Determine the International Equity Dimension

Factors to consider are:

• Home bias

• Global Diversification: correlations among unhedged global equity markets are modest.

• Currency Risk

Asset Allocation

Fixed Income 40%

Fixed Income 40%

UK Equity 27%

International Equity 21.6%

Emerging Equity 5.4%

Global Property REIT 6.0%

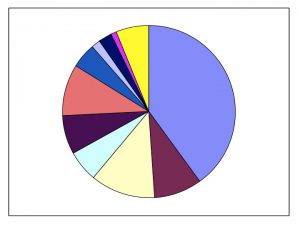

Step 3. Determine the Size & Value Equity Dimension

Factors to consider are:

• Risk/Return: Increasing allocation to small and/or value stocks may increase risk, expected return and tracking error but may not increase volatility.

• Sensitivity to tracking error: Increased sensitivity to prolonged periods of underperformance to the market.

Asset Allocation

Fixed Interest 40%

Fixed Interest 40%

UK Market 9.0%

UK Value 12%

UK Small Cap 6.0%

International Markets 7.2%

International Value 9.6%

International Small Cap 4.8%

Emerging Markets 1.8%

Emerging Value 2.4%

Emerging Small Cap 1.2%

Global Property REIT 6.0%

The process of diversifying the portfolio to capture the five dimensions of risk identified by Fama & French generally has the effect of increasing expected return with no additional or even reduced “cost” in terms of risk. The methodology could be used to construct any number of portfolios by combining different percentages of the available components.