You may think that the benefits of financial advice are purely monetary, but there can be many wider benefits to your clients’ lives as well.

Indeed, as reported by FTAdviser, 2 in 5 of those who see a financial planner said their mental health and family life had benefited.

Working with a financial planner can help to improve your clients’ quality of life in many ways, but perhaps most significantly, it can help by reducing their uncertainty around their finances, and the anxiety and stress that comes with that.

Read on to discover three ways working with a financial planner could improve your clients’ quality of life.

1. It can help your clients feel in control and confident

Without the help of a financial planner, it’s easy for your clients to feel out of control when it comes to their finances.

One of the key benefits of working with a professional is that they can help a client to consider what their future goals are, and to make a detailed financial plan. With this in place, your clients can clearly see the steps they need to take to reach their goals, giving them greater certainty, and a feeling of control over their future life and finances – a feeling that can boost their quality of life.

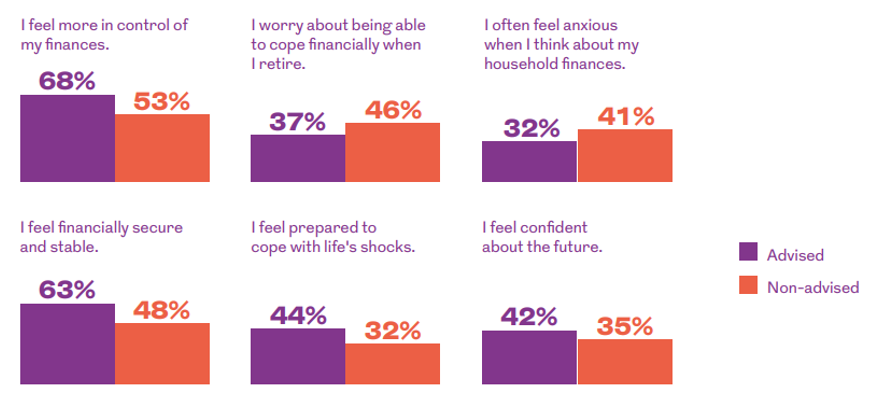

In turn, this can make them more confident about their financial future. Indeed, a study from Royal London found that 68% of individuals who had received financial advice felt more in control of their finances, compared to 53% of those who hadn’t sought advice.

Source: Royal London

Those who had received financial advice also felt more financially secure and stable, less anxious when thinking about household finances, and more able to cope with life’s shocks.

2. It means your clients can be ready for unexpected shocks

Though not fun to think about, unexpected events are a part of life. Whether your client’s car breaks down, they receive a large vet bill, or they are faced with more serious life events like losing a job, falling ill, or the death of a loved one, shocks can derail long-term life and financial plans.

Yahoo! Finance reports that 1 in 3 adults in the UK don’t feel confident about their financial resilience – that is, their ability to withstand unexpected expenses. Without preparation, financial shocks, and the prospect of them, can be a source of worry.

With help from a financial planner, your clients can mitigate the negative fallout from these events, reducing their anxiety levels and contributing to an improved quality of life.

A financial planner could help one of your clients prepare for such shocks by:

Helping to build an emergency fund

An emergency, or “rainy day” fund is money set aside to cover expenses in the event of an unexpected event. Most experts recommend holding around three to six months of expenses in an easy access savings account.

Advising on what forms of protection could benefit them

There are many forms of protection that could benefit your client, but without help, choosing the type of cover that’s right for them can be a challenge.

Protection can help in events such as:

- Being long-term sick and unable to work

- Receiving a serious illness diagnosis

- Your client’s partner or spouse passing away.

If you have business owner clients, a financial planner can also help them to increase the financial resilience of their business, potentially reducing their stress and improving their quality of life.

Aiding in writing or updating a will

If you have a client who doesn’t have a will, it could be important that they create one. A financial planner can help them to decide what they want to happen to their estate when they die, and with help from a solicitor, construct a will for them.

If your client already has a will, it’s important they update it as their circumstances change. Events like the birth of a child, a change in their finances, or getting married could change how they want their estate to be distributed upon their death.

Assisting in creating a Lasting Power of Attorney

A Lasting Power of Attorney (LPA) is a legal document that grants a nominated person the right to manage your client’s affairs for them, in the event they become unable to do so.

This can reduce worry for not just your client, but their family as well. If they do become unable to manage their affairs and they haven’t created an LPA, then a loved one will have to apply for the right to manage their affairs which can be a difficult process.

3. It can reduce your clients’ worry around retirement

City A.M. recently reported that 58% of adults in the UK are anxious about their retirement, with 40% worried that they may not have enough money to last them until the end of their life.

This is an understandable worry, but it can be mitigated with the help of a financial planner.

A financial planner can use their expertise to look at your clients’ finances and answer questions like:

- How much money do they need to retire?

- When will they be able to retire?

- How much do they need to save now to reach their retirement goals?

- Will they be able to pursue their interests, hobbies and travel plans when they retire?

Additionally, a financial planner may be able to use methods such as cashflow modelling to forecast your clients’ financial future using assumed rates of growth, inflation, market performance, and income.

By knowing your clients’ retirement goals, a planner can advise them on whether they are on track to achieve these goals, and if they’re not, recommend changes to help them get there.

This can help take the guesswork out of planning for their retirement, removing uncertainty and hopefully making them feel less anxious about money in their retirement. This can help to improve their quality of life both now and in the future.

Get in touch

If you have clients who you believe could benefit from receiving advice from a financial planner, they can email info@santorini-fp.co.uk or call 01509 278620 to find out more about how we can help.

At Santorini Financial Planning we are Registered Life Planners (RLP). Our RLP designation demonstrates our ability to listen deeply and help clients discover, articulate, and then achieve their life goals, helping them towards the best quality of life we can.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The Financial Conduct Authority does not regulate estate planning, cashflow planning, Lasting Powers of Attorney, or will writing.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Cover is subject to terms and conditions and may have exclusions. Definitions of illnesses vary from product provider and will be explained within the policy documentation.