Blog

Search articles

The challenges of balancing different goal time frames

When you think about financial and lifestyle goals, there are probably several, each with a different timeframe. Juggling them and weighing up your priorities can be challenging. Should you focus on paying off your mortgage quickly now, or saving into…

Read more

What’s pound cost averaging and how does it work?

When investing, there are numerous questions to answer, from how much risk you want to take to how much you’ll invest. Among these is how you’ll build up your portfolio. There are essentially two options to consider: deposit a single…

Read moreLonger lives and retirement plans

Retirement is a huge milestone and one that’s lasting longer for many people. You now have more choice around when you want to retire, how to take an income, and what you want to do after you’ve given up work.

Read more

Why it’s important to revisit your financial plan

Once you’ve set out a financial plan, you might think all the hard work has been done. But keeping on top of the progress you’re making and ensuring it’s still suitable is essential for getting the most out of your…

Read moreInheritance Tax is on the rise: Seven ways to mitigate the bill

When estate planning, Inheritance Tax (IHT) can be a concern. Naturally, you want to leave as much as possible to your loved ones and ensure they’re not stressed about paying a bill at what is already a difficult time. Luckily,…

Read more

Seven steps to take when you’re passing on wealth to loved ones

If you’re in a position to support loved ones financially, it can be difficult to know what to do. How should you go about passing on your wealth, helping to improve their financial security? There is more than one option…

Read moreWhy regular financial reviews are critical for achieving aspirations

You’ve set out a financial plan and followed the course of action you were advised on. Now, you can simply kick back and forget about it, right? Wrong. Effective financial planning is about much more than simply coming up with…

Read more

Considerations when you’re saving for a child’s future

With university fees, rising house prices and other financial pressures, young adults can struggle to achieve financial security and tick off milestones. If you’ve got children or grandchildren, you may be considering starting a nest egg to help them along…

Read moreInvesting in VCTs: What you should know first

Investing in a fledgling business can deliver returns and tax incentives, but this needs to be carefully balanced with the risks of doing so. Start-ups might offer high growth potential, but a significant portion of new firms also end up…

Read more

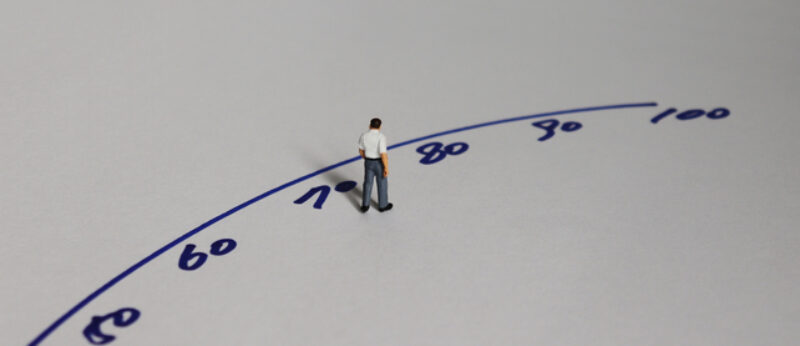

The importance of longevity when planning for the future

When you’re planning your financial future, you’ve probably considered how much you need and how much you can afford to put away. But when you’re planning your retirement, have you factored in longevity? At a time when retirees can access…

Read moreShould you stop pension contributions if you’re approaching the Lifetime Allowance?

If you’ve been saving into a pension throughout your working life, you might be closer to the Lifetime Allowance than you think. Going over the threshold could mean facing additional tax charges on your future income and, as a result,…

Read more

The pros and cons of purchasing an Annuity at retirement

Since Pension Freedoms were introduced in 2015, more of us are choosing to access our pensions flexibly when we reach retirement. With greater choice, the number of retirees opting to purchase an Annuity is falling, but is it still a…

Read more

Get in touch

ADDRESS

Unit 6

37 Old Parsonage Lane

Hoton

Loughborough

Leicestershire

LE12 5SG